A platform built on big data and cloud computing, deployed since 2019 across 26 countries, including Kenya, Nigeria, Mexico, the Philippines, and Pakistan.

A platform built on big data and cloud computing, deployed since 2019 across 26 countries, including Kenya, Nigeria, Mexico, the Philippines, and Pakistan.

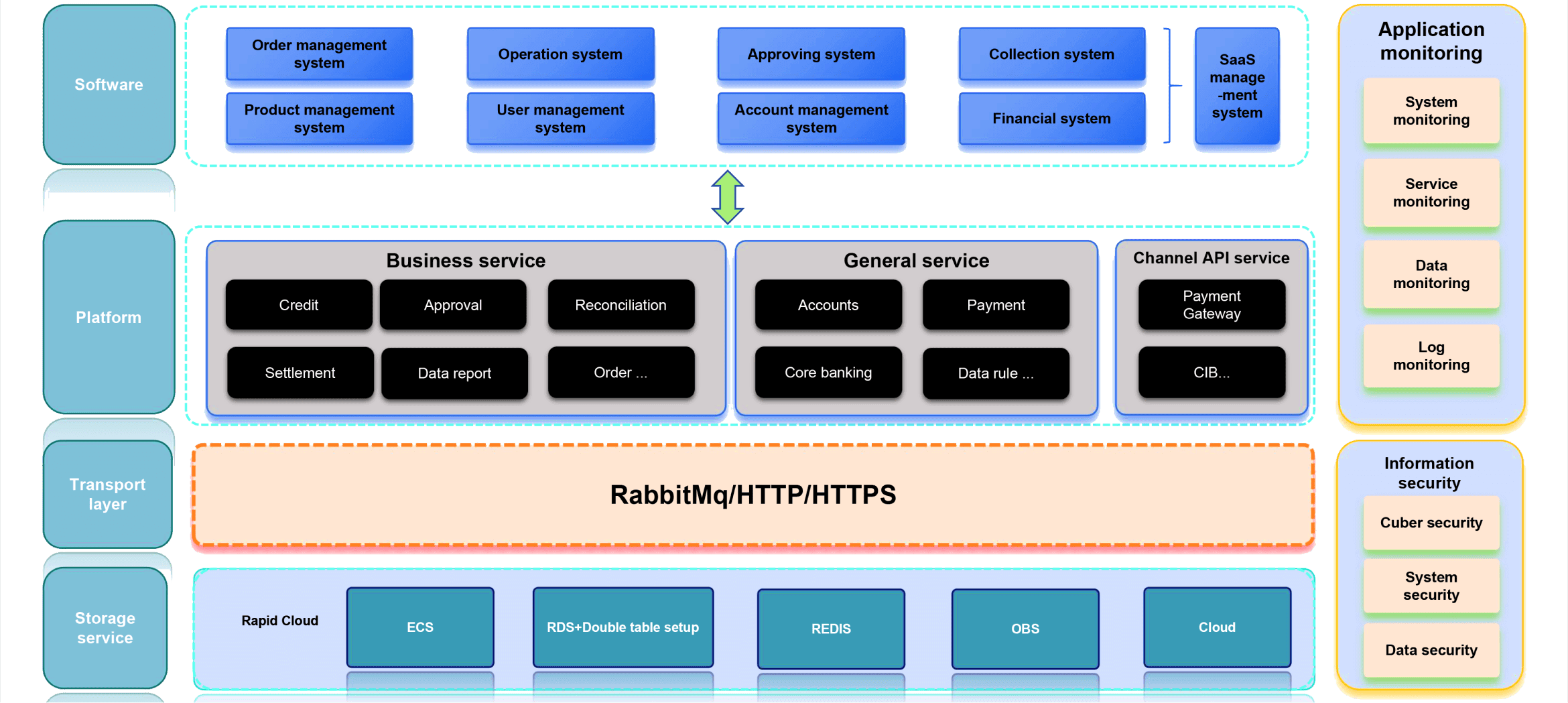

Integrated platform solution enabling rapid deployment

Cloud-based architecture with support for on-premises deployment

Containerized microservices for elastic scalability with business growth

Fully automated credit assessment completed within 5 seconds

Real-time disbursement completed within 1 minute

Simple and fast application process — from registration to disbursement in as little as 5 minutes

Comprehensive Big Data

Coverage

Covers device data, operational patterns, social networks, and more

Addresses gaps in external credit bureau and third-party data

Integrates structured, unstructured, sparse, and weakly correlated data for robust risk analysis

Integrated Machine

Learning Risk Platform

Cutting-edge ML Algorithms - Develops models for low-coverage, weak-information datasets, leveraging both structured and unstructured data

Unified Modeling & Deployment Platform - Core models can be rapidly replicated across international markets; personalized feature generation and automated calculation systems adapt to diverse country-specific data

Centralized Model Management - Unified model release, update, and monitoring system ensures consistent deployment and oversight globally